The coronavirus pandemic is knocking the most susceptible Americans, pushing many into economically precarious situations.

The very best method to fight the financial fragility that’s brought on by such an occasion is helping Americans build and preserve an emergency situation savings fund, according to specialists.

But many people require the support of the federal government and corporations to make that occur, they stated.

“The differences between the haves and the have-nots with regard to these measures of financial fragility have just burnt out,” said Peter Tufano, dean at University of Oxford’s Saïd Organization School, during a Wednesday webinar hosted by the Global Financial Literacy Excellence Center. “We do not see any natural break in this unless something takes place.”

The information is in fact alarming.

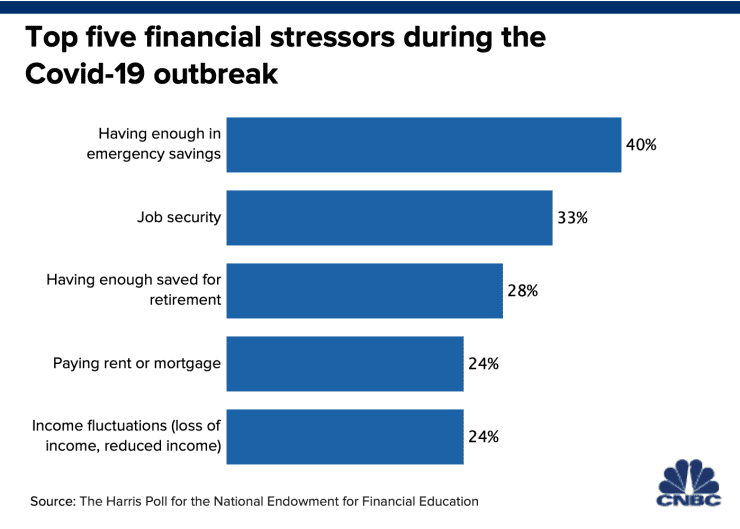

Even prior to the coronavirus pandemic, nearly 40% of Americans didn’t have adequate savings to pay for an unexpected $400 expenditure, according to a survey from the Federal Reserve. Because the pandemic hit the U.S., millions have been pressed even more to the edge– more than 20 million are collecting unemployment advantages, millions are experiencing food insecurity and more are at risk of losing real estate.

Besides, the pandemic has broadened inequality in the U.S. For the upper class, the recovery is well underway, while those on the other end of the earnings spectrum continue to suffer.

“What’s a lot more unpleasant is the divergence in racial injustice in the U.S. right now,” stated Billy Hensley, president, and CEO of the National Endowment for Financial Education, adding that families of color have made more monetary changes than their White counterparts.

As numerous as 86% of Black families and 74% of Hispanic families had changed their individual finances due to Covid, according to an October study from NEFE. In comparison, 70% of White families had done the same, the survey revealed.

Another stimulus cost is required now

In the short-term, the service to decreasing monetary fragility is clear, according to Tufano.

“The something that can be done rapidly is we hope that the federal government– the U.S. government– will find some method to handle Washington in the way they had with the CARES Act,” he stated.

In the early months of the pandemic, the federal CARES Act provided direct $1,200 stimulus checks to numerous Americans and expanded joblessness advantages to include an additional $600 weekly, cash that assisted individuals to boost savings, remain existing on rent and other expenses, and more. That kept the gap between the employed and unemployed small and steady, according to Tufano.

When that additional cash ran out, the rift between those with and without tasks began to widen rapidly, according to a paper published by GFLEC in October.

It’s uncertain if additional stimulus will come quickly, as Congress has failed to reach a deal after months of negotiations. Even if an offer is reached quickly, countless Americans will fall off a cliff at the end of the year when 2 unemployment programs and other protections end.

Long-term modifications need to be made

Of course, another round of coronavirus relief would only assist in the short-term. Making sure that Americans have emergency savings to stand up to crises over the long-lasting methods eliminating barriers to monetary planning, policy modifications resolving concerns such as unequal pay and better education, professionals state.

“You can be economically literate but if you don’t have access to a quality job or a fair paying job, then what you understand can’t be used,” Hensley said.

He likewise included that widespread personal financing education is a step in the ideal instructions. In the U.S. currently, just half of all states need a personal financing course prior to graduation, and trainees of color are less most likely than their White counterparts to have that education.

In addition, corporations must extend more aid in increasing emergency funds, such as including them as an advantage similar to retirement savings.

“These are structural problems that require to be handled,” Tufano stated.